Filing VAT with MTD

File your VAT return with HMRC's Making Tax Digital (MTD)

Dear VAT Registered business,

We can get you MTD compliant for the 1st April 2022 DEADLINE!

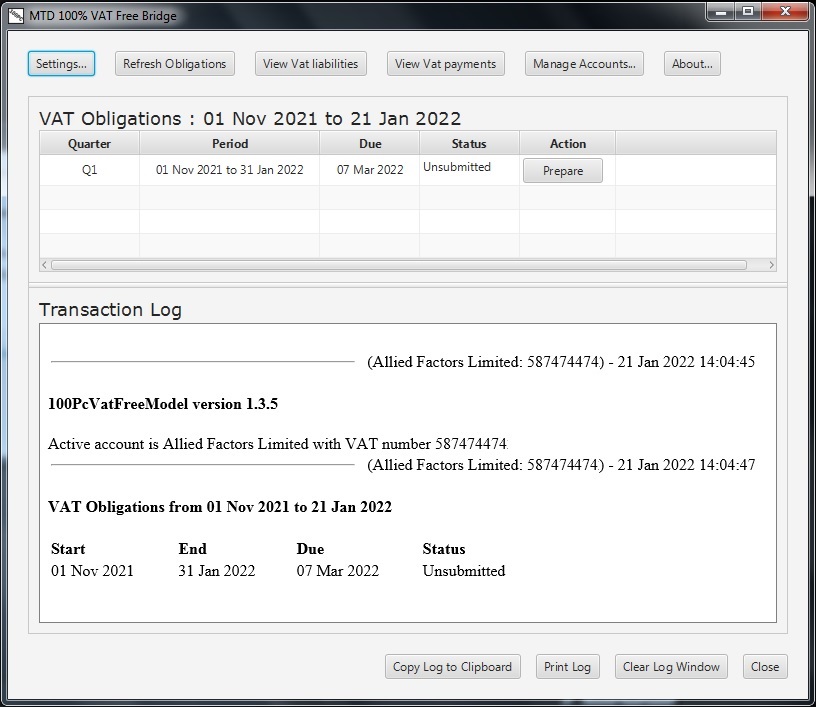

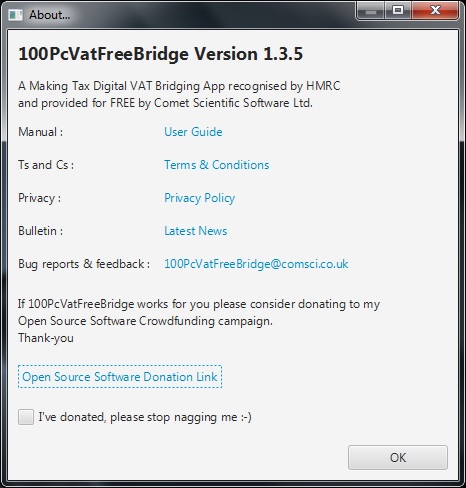

We recommend a FREE piece of software called 100 PC MTD, which is accredited by the HMRC.

It is supplied by Comet Scientific Software Limited (all trademarks and copyrights acknowledged).

https://www.comsci.co.uk

See Download link, below:-

We provide the expertise to set up your accounting Data Source correctly.

This is done by using Microsoft's Excel spreadsheet product.

A qualified accountant will help you go live within TWO hours,

which can be done remotely to anywhere in the UK.

We'll cut through the red tape for a fixed fee of £200+VAT

Email us on: mail@alliedfactors.com

What's needed to comply with MTD?

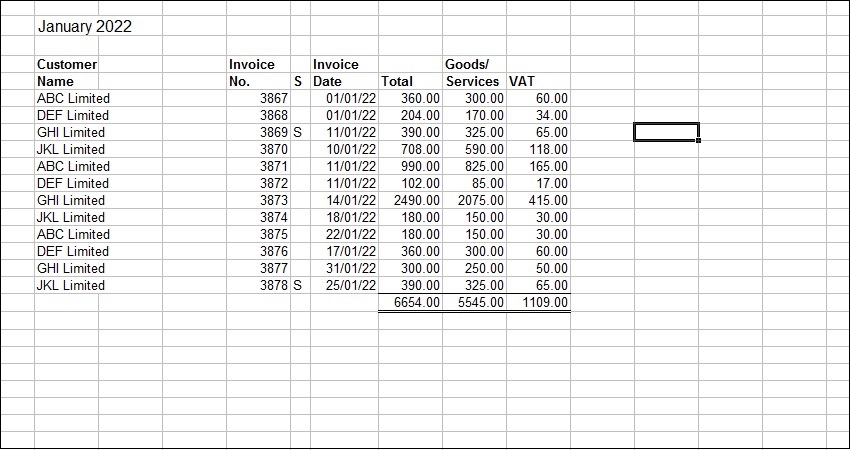

[1] XLS Data Source which includes

[2] Quarter summaries

[3] Sales Day Book entries

[4] Cash book entries

[5] Petty cash entries

[6] Download and install the software

[7] Setup details and grant HMRC authority

[8] Connect to HMRC to identify VAT Returns due

[9] Submit your first MTD VAT Return

HMRC MTD legal obligations

From April 2019: MTD VAT is mandatory for VAT-registered businesses and

organisations (including sole traders, partnerships, limited companies,

non-UK businesses registered for UK VAT, trusts and charities) with

taxable turnover above the VAT threshold. There was a six-month deferral

of the start date, to 1 October 2019, for some more complex businesses.

From April 2022: MTD VAT is mandatory for all VAT-registered businesses

and organisations.

Businesses and organisations (which includes those with income from property)

are required to maintain digital accounting records. Maintaining paper

records ceases to meet the requirements of the tax legislation.

Businesses and organisations are required to use a functional

compatible software product to submit updates and returns to HMRC.

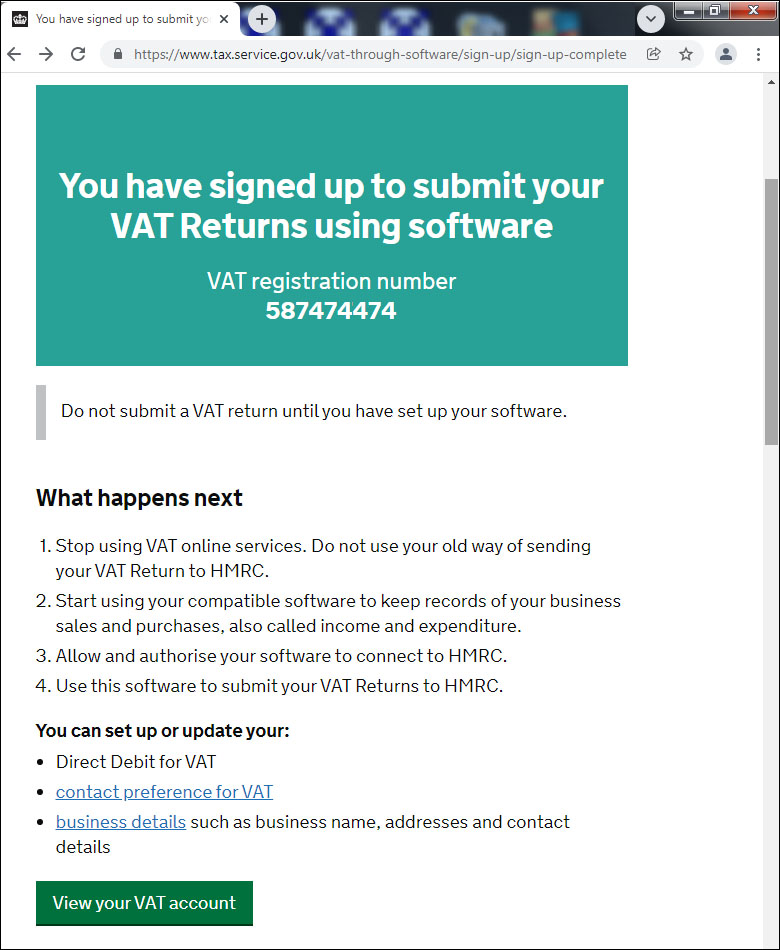

The software uses HMRC's API (Application Program Interfaces) platform

to submit information to HMRC. The current HMRC online tax return services

for the relevant tax are withdrawn when a business signs up to MTD.

From April 2019 VAT registered businesses and organisations with taxable

turnover above the VAT threshold of £85,000 are required to:

Maintain their accounting records digitally in a software product

or spreadsheet. Maintaining paper records no longer meets the

requirements of the tax legislation.

Link: https://www.comsci.co.uk/100PcVatFreeBridge.html

HMRC Register for MTD for VAT

HMRC VAT MTD Obligations

100PCVAT Bridge Version# 1.3.5

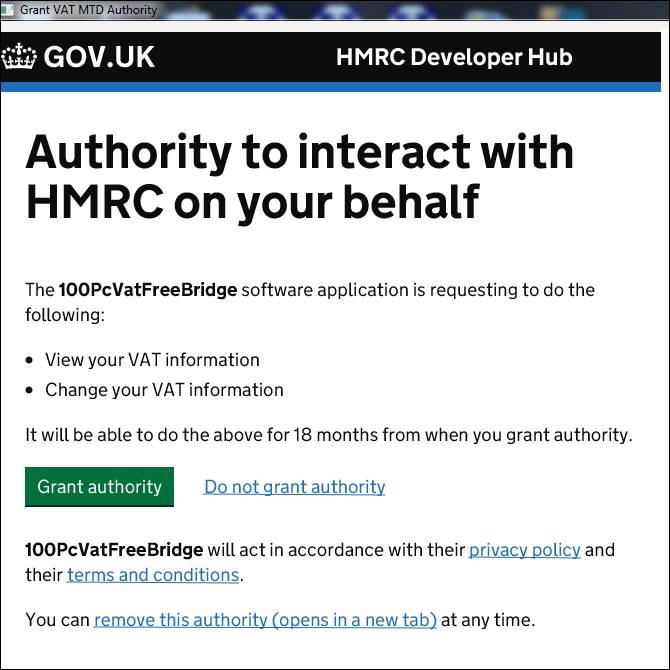

HMRC Government Gateway authority

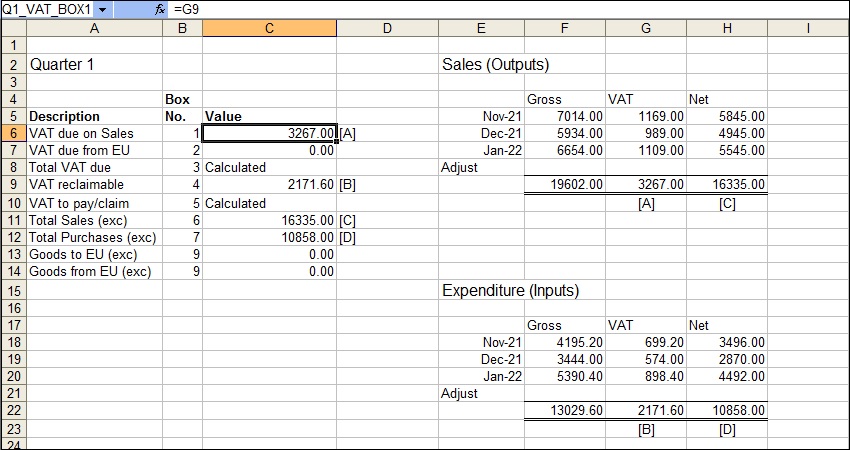

MTD VAT Return Summary example

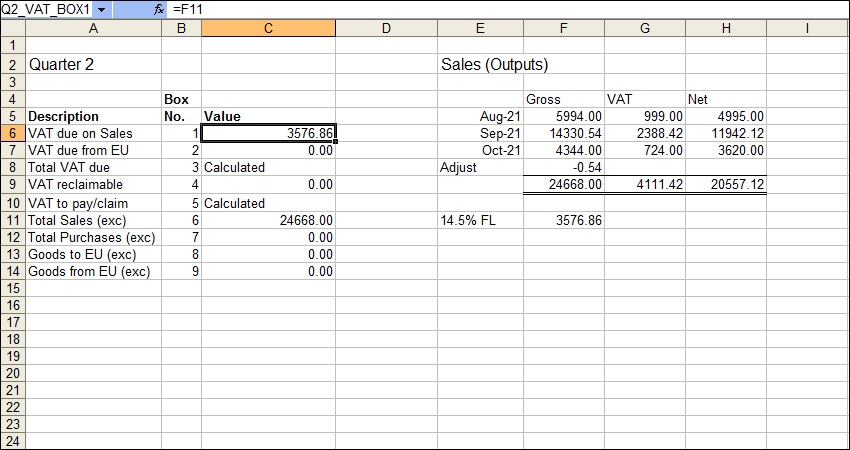

MTD VAT Return Summary example - Flat rate scheme

MTD VAT Sales Day Book